New York State Itemized Deductions 2025

New York State Itemized Deductions 2025 - Download Instructions for Form IT196 New York Resident, Nonresident, There is no way to choose which deduction is used on your new york tax return. New York State Itemized Deductions 2025. The new york tax estimator lets you calculate your state taxes for the tax year. Now, if you are 65 or.

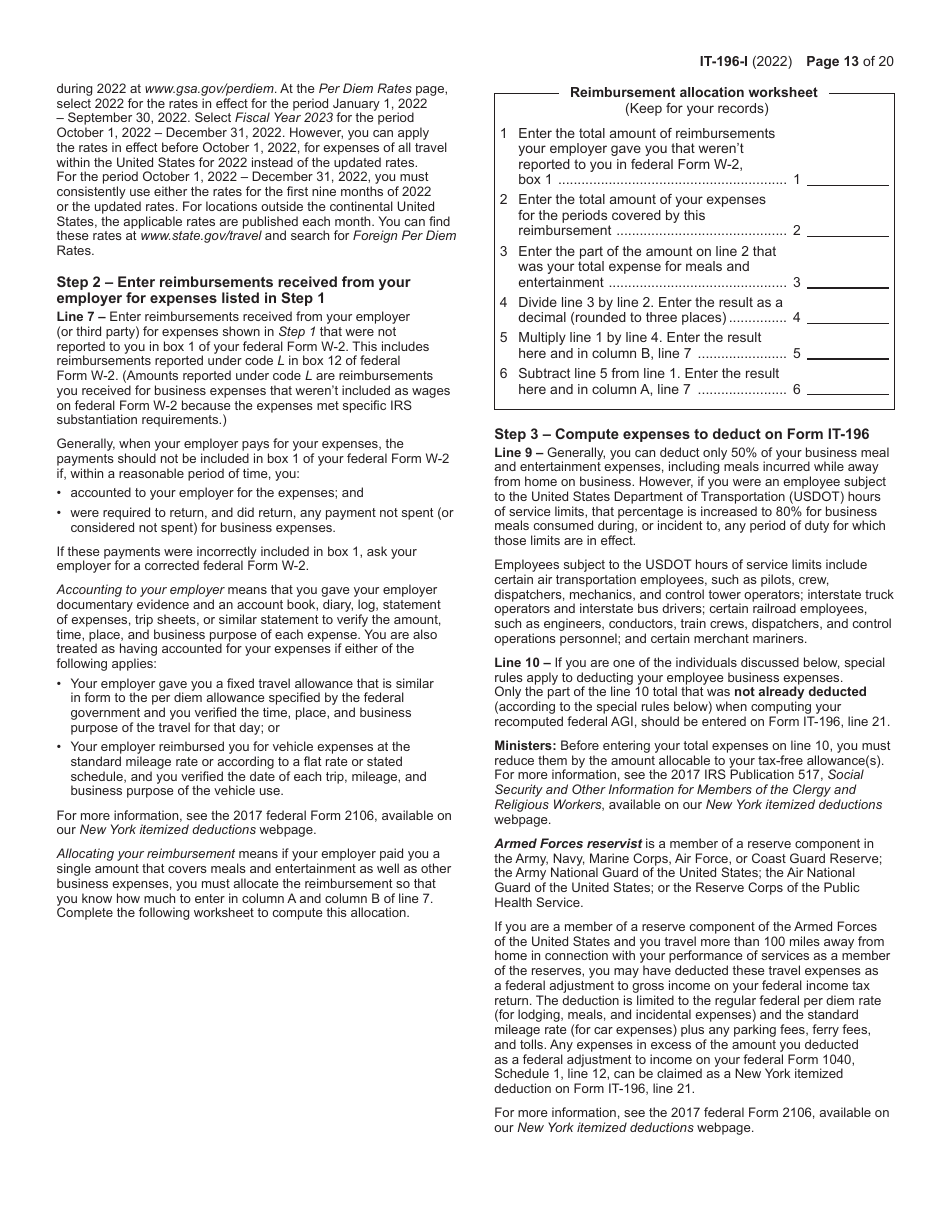

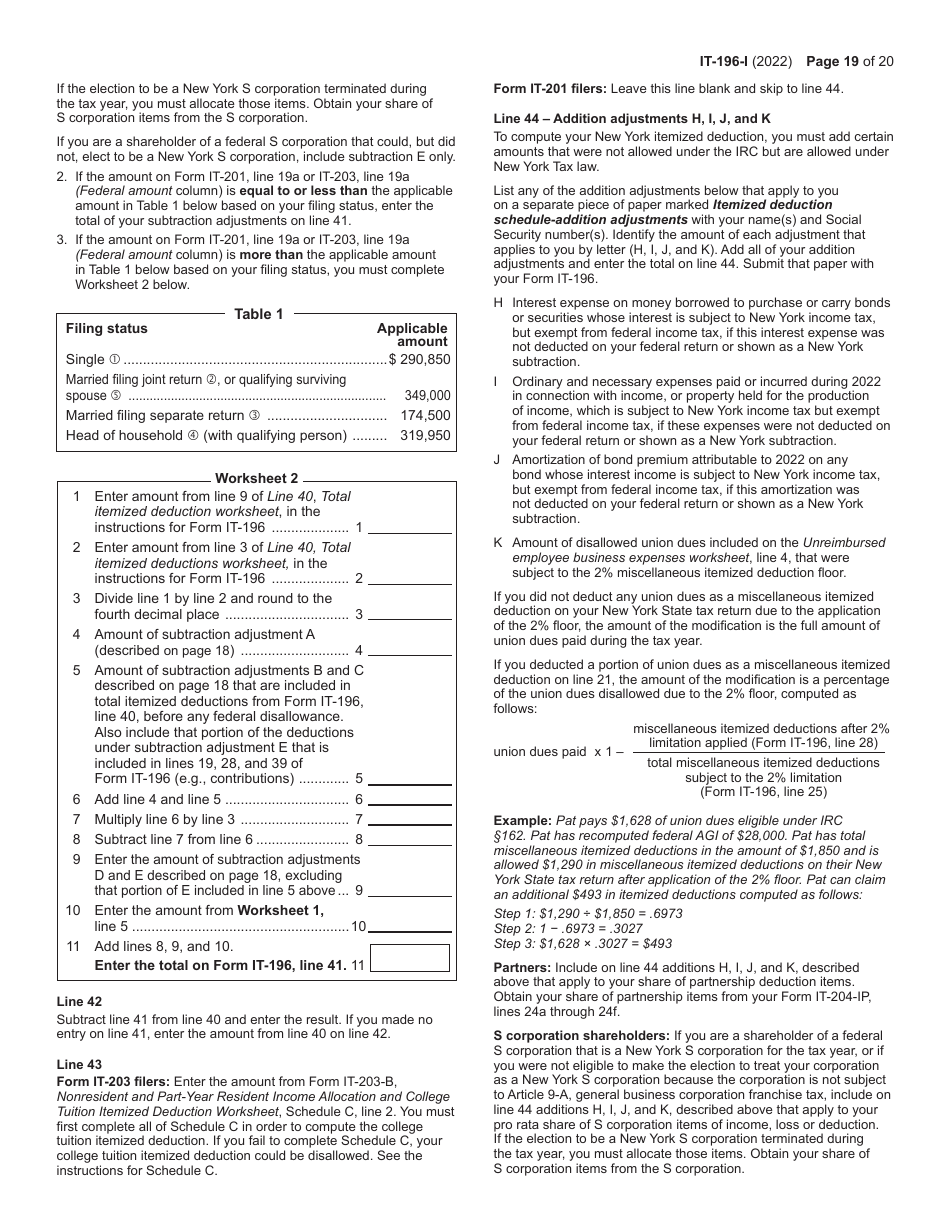

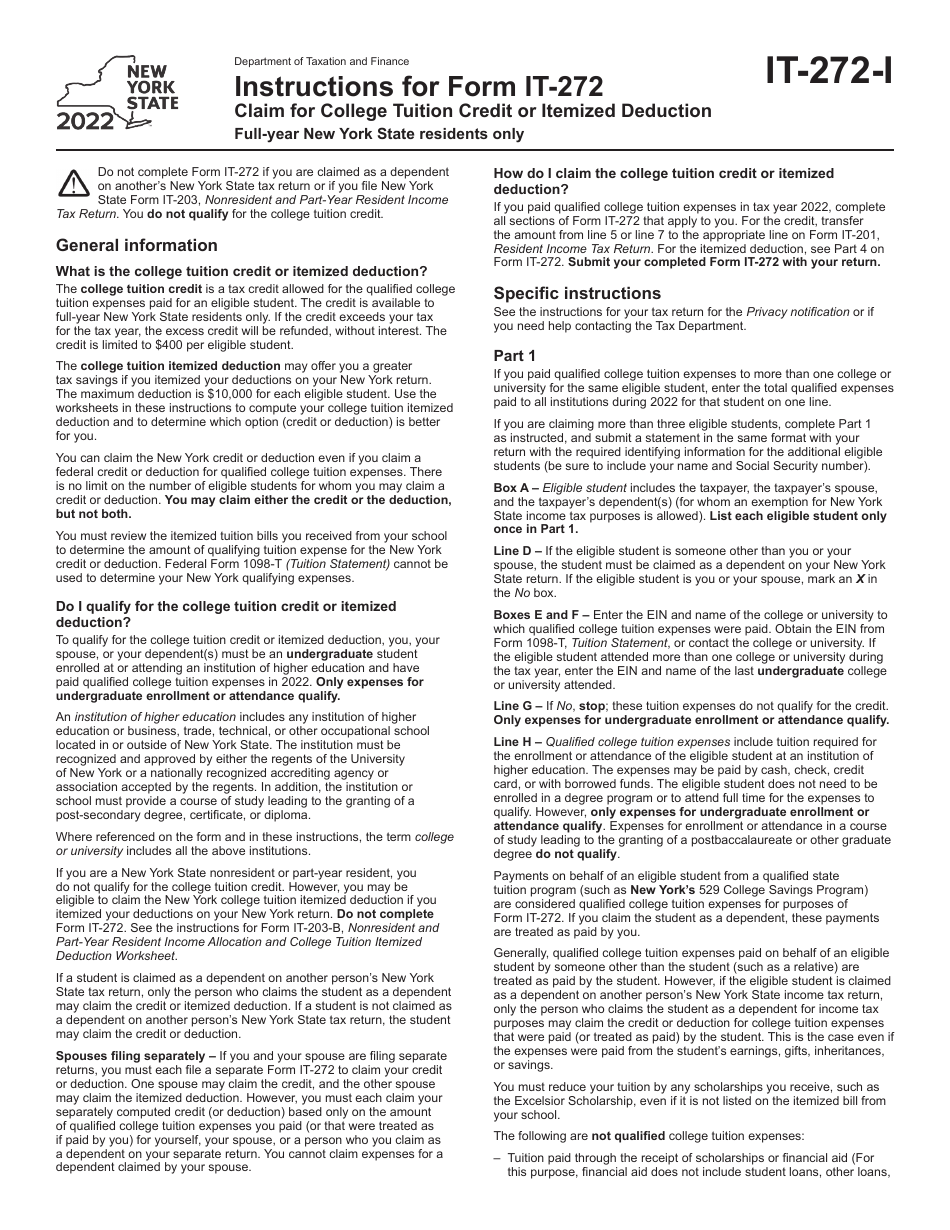

Download Instructions for Form IT196 New York Resident, Nonresident, There is no way to choose which deduction is used on your new york tax return.

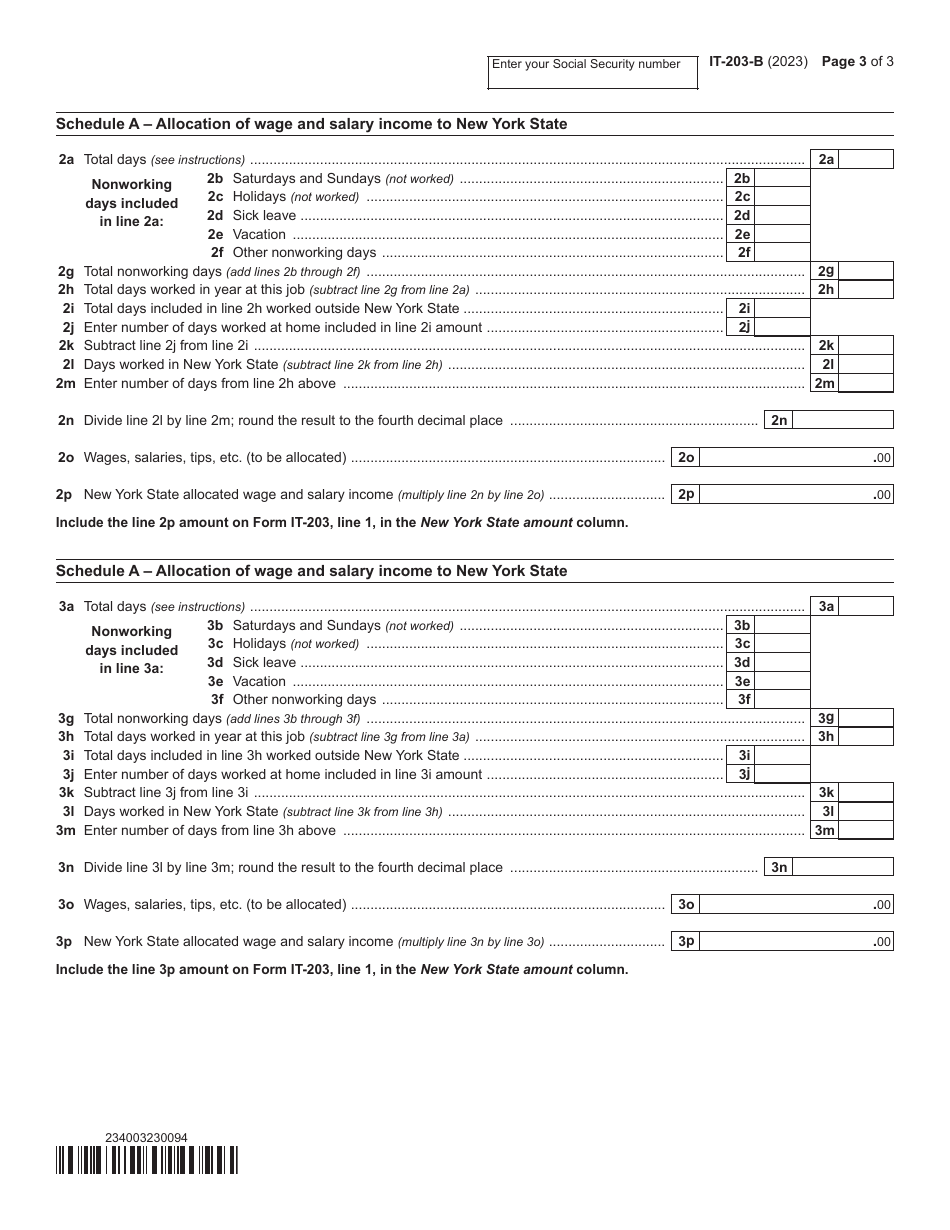

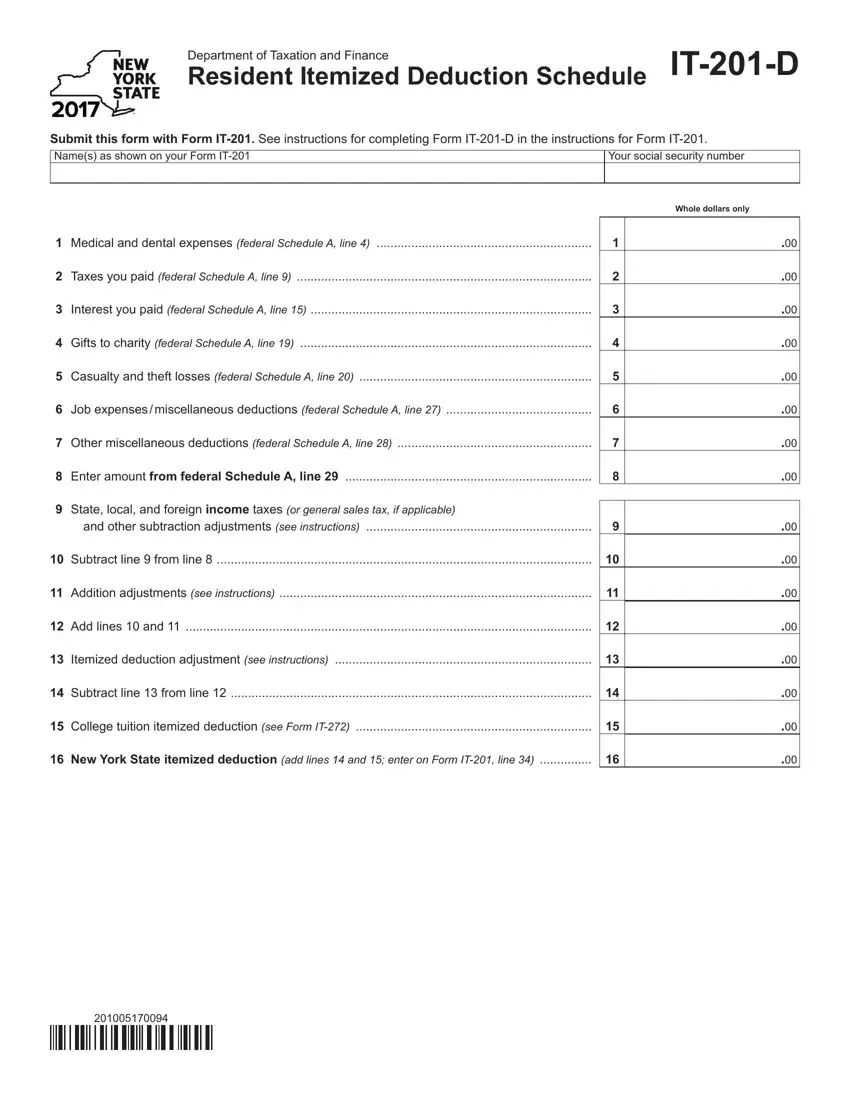

Nys It 201 D ≡ Fill Out Printable PDF Forms Online, To enter any of these adjustments to your itemized deductions on your new york return, follow the steps below:

Download Instructions for Form IT196 New York Resident, Nonresident, That additional amount will be $1,600 ($2,000 if unmarried and not a surviving spouse).

We’ll cover who needs to file, how to check your residency status for tax purposes, what deductions and credits are available, and more. Now, if you are 65 or.

2025 New York Itemized Deduction Webpage Dayna Ernesta, To enter any of these adjustments to your itemized deductions on your new york return, follow the steps below:

New York State 2025 Tax Brackets Jammie Sarajane, Here’s a refresher on some of the most common:

New York City Corporate Tax Rate 2025 Gussi Jerrilyn, There is no way to choose which deduction is used on your new york tax return.

New York State Standard Deduction 2025 Nicholas Churchill, Find detailed information about new york state income tax brackets, rates, and standard deductions by tax year.

Itemized Deductions In 2025 Ryan Davies, For 2025, the standard deduction will rise by $400 to $15,000 for single filers, $800 to $30,000 for married couples filing jointly, and $600 to $22,500 for heads of household.

Itemized Deductions In 2025 Ryan Davies, For 2025, the standard deduction will rise by $400 to $15,000 for single filers, $800 to $30,000 for married couples filing jointly, and $600 to $22,500 for heads of household.